multistate tax commission members

53 rows The Commission offers services to the public and member states. You can find the Multistate Tax Commissions webpage HERE.

Deftly Navigating An Mtc Audit Considerations For Taxpayers Tax Executive

Appointment of multistate tax commission member.

.jpg.aspx?lang=en-US?width=250&height=306)

. Helen Hecht General Counsel Multistate Tax Commission Ms. While full members are required to adopt the Compact including UDITPA. Establishes a commission whose purposes are 1 to facilitate proper determination of state and local tax liability of multistate taxpayers 2 to promote uniformity and compatibility in significant components of tax systems 3 to facilitate taxpayer convenience and compliance 4 seeks to avoid duplicate taxation 5 conducts audits of major corporations on behalf of.

All state personnel present or on the phone during a meeting are welcome to participate as members of the Committee and can offer motions or amendments and participate in Committee discussion etc. Are states represented by the heads of the tax agencies administering corporate income and sales and use taxes that have enacted the Multistate Tax Compact into their state law. The Multistate Voluntary Disclosure Program MVDP provides a way for a taxpayer with potential tax liability in multiple states including the District of Columbia to negotiate a settlement using a uniform procedure coordinated through the National Nexus Program NNP staff of the Multistate Tax Commission Commission.

MEMBERS OF BBB NATP. Revised July 25 2013. This is not the official website of the Multistate Tax Commission.

On March 4 2013 TEI submitted a memorandum to the Multistate Tax Commission MTC urging it to abandon a proposed project aimed at creating model regulations governing the use of state. The governor shall appoint the member of the multistate tax commission to represent New Mexico from among the persons made eligible by Article VI 1a of the compact 7-5-1 NMSA 1978. Rest easy knowing your taxes will be properly handled every single year with the help from the experienced team at Multistate Tax Inc.

Multistate Tax Commission June 13 2018 Page 3 of 10. 1953 Comp 72-15A-39 enacted by Laws 1967 ch. Sovereignty member s are states that support the purposes of the Multistate.

TEI Comments on the Multistate Tax Commissions Section 482 Project. Get a brief overview of Multistate Tax and see our current team of knowledgeable and dedicated employees. These states govern the Commission and participate in a wide range of projects and programs.

Each member State is authorized to request that the Commission perform an audit on its behalf and the Commission may seek compulsory process in aid of its auditing power in the courts of any State specifically permitting such procedure. The Multistate Tax Commission has filed an amicus brief with the Oregon Tax Court in Santa Fe Natural Tobacco Co. This case considers whether in-state activities conducted by an independent contractor pursuant to a contract with an out-of-state seller negates the sellers PL.

The Nexus Committee was formed under Article VI2 of the Multistate Tax Compact and bylaw 6 b to oversee the National Nexus Program. As of 2021 the District of Columbia and all 50 states except for Nevada are members in some capacity. Organization and Management a The Multistate Tax Commission is hereby established.

This text is quoted verbatim from the original source. Members of the public are invited to provide comments as well. The Multistate Tax Commission is an interstate instrumentality located in the United States.

At the end of last year the SITAS Committee appointed its new Chair- Krystal Bolton who is also an. Brian Hamer Hearing Officer Multistate Tax Commission. The Multistate Tax Commission MTC is set to revamp its transfer pricing collaboration and enforcement initiatives following the first public meeting of its State Intercompany Transactions Advisory Service SITAS Committee in over four years.

Explanation This amendment provides 25000 from the general fund each year for the Department of Taxation pursuant to the passage of House Bill 373 of the 2018 General Assembly Session which requires the Virginia to become an associate member of the Multistate Tax Commission and to participate in Multistate Tax Commission discussions and meetings. Committee Members Committee membership is voluntary and inclusive. Neither the Compact nor the positions taken by the Commission as represented by the revenue secretaries of the member states are binding on member states.

Made by Commission members and in Commission publications eg. National Center for Interstate Compacts Multistate Tax Compact accessed February 8 2016 Multistate Tax Commission Member States accessed February 17 2021 Multistate Tax Commission About us accessed October 19 2011 Note. Gregory Matson Executive Director Multistate Tax Commission Ms.

Any inconsistencies are attributable to. Commission members acting together attempt to promote uniformity in state tax laws. These states govern the Commission and participate in a wide range of projects and programs.

The Multistate Tax Commission MTC is updating its Public Law 86-272 guidance Statement of Information Concerning Practices of Multistate Tax Commission and Signatory States under Public Law. Compact members are states represented by the heads of the tax agencies administering corporate income and sales and use taxes that have enacted the Multistate Tax Compact into their state law. 86-272 income tax immunity.

It is the executive agency charged with administering the Multistate Tax Compact. The Executive Committee meets quarterly and is comprised of the Commission Chair Vice-Chair Treasurer and four elected members. Lila Disque Deputy General Counsel Multistate Tax Commission Mr.

The Commission does not. Committee member Richard OConnor and TEI Tax Counsel Pilar Mata attended the meeting. To these ends the Compact created the appellee Multistate Tax Commission.

It shall be composed of one member from each party State who shall be the head of the State agency charged with the administration of the types of taxes to which this compact applies. The National Nexus Program is a program of the Multistate Tax Commission MTC created by and composed of member states. Multistate Tax Commission Review September 2001.

This website is maintained for the public benefit and a historical perspective on the activities of the Commission from 2010-2018. The Executive Committee is the primary policy and administrative decision-making body of the MTC when the full Commission does not meet.

Greg Matson Executive Director Multistate Tax Commission Linkedin

Multistate Tax Commission News

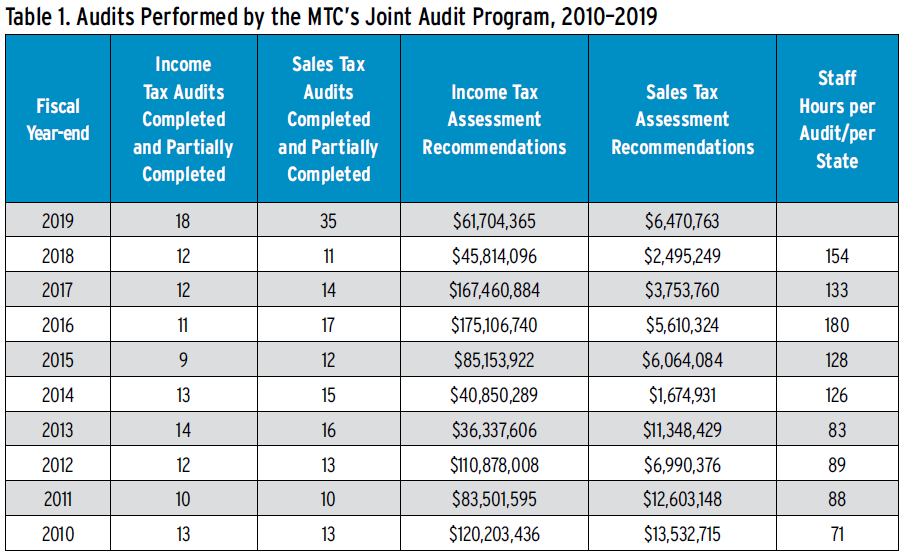

Importance Of State And Local Tax Planning Various Types Of Taxes Levied On Business Review Table 1 1 Various Business Transactions Subject To Taxation Ppt Download

Case Study Multistate Tax Agency Mtc Cleo

Chris Barber Counsel Multistate Tax Commission Linkedin

.jpg.aspx?lang=en-US?width=250&height=306)

Multistate Tax Commission News

.jpg.aspx)

Multistate Tax Commission News

Multistate Tax Commission Home

Uniformity Committee Memo Multistate Tax Commission

Deftly Navigating An Mtc Audit Considerations For Taxpayers Tax Executive

Multistate Tax Commission With Helen Hecht Taxops

.jpg.aspx?width=350&height=400)

Multistate Tax Commission News

Multistate Tax Commission Home

The Significance Of The Multistate Tax Compact And Uditpa Amid Recent Developments Accountingweb

Uniformity Committee Memo Multistate Tax Commission

United States The Multistate Tax Commission Is Primed To Revamp Its Multistate Transfer Pricing Collaboration And Enforcement Initiatives Global Compliance News

Ppt Importance Of State And Local Tax Planning Powerpoint Presentation Id 3058059