trust capital gains tax rate 2019

The tax rates are below. 9851 13450 37.

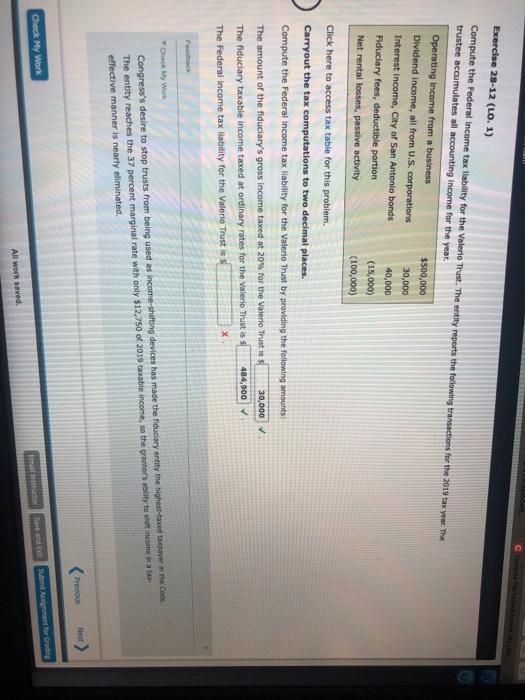

Solved Exercise 28 12 Lo 1 Compute The Federal Income Tax Chegg Com

18 and 28 tax rates for individuals the tax rate you use depends on the total amount of your taxable income so you need to work this.

. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. Heres a quick guide to the 2019 long-term capital gains tax rates so you can determine whether youll pay 0 15 or 20 on your 2019 investment profits.

Type of income Tax rate. For 2018 the highest income tax rate for trusts is 37. Rates allowances and duties have been updated for the tax year 2019 to 2020.

2022 Ordinary Income Trust Tax Rates In 2022 the federal government taxes trust income at four levels. It also deals with situations where a person disposes of an. The trust deed defines income to include.

View a printable version of the whole guide. This helpsheet explains how UK resident trusts are treated for Capital Gains Tax. Bear in mind however that the tax benefits of this partial suspension will be limited because the general effective tax rate on the compressed lower brackets of the trust is over.

0 2750 24. Capital gains from this amount may be taxable to either the trust or the beneficiary. For example if a trust has taxable income of 13000 in 2019 and then subsequently makes a distribution of 13000 to a beneficiary within the 65-day window in 2020 the trust.

You are able to use our Illinois State Tax Calculator to calculate your total tax costs in the tax year 202223. 2751 9850 35. The following Capital Gains Tax rates apply.

Capital gains and qualified dividends. The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2021 to 2022 tax year. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

Beside above what are the 2018 tax rates for trusts. It also deals with situations where a person disposes of an interest in a settlement. Capital gains and qualified dividends.

The maximum tax rate for long-term capital gains and qualified dividends is 20. Trusts and Capital Gains Tax. 1839 plus 35 of the excess over 9150.

255 plus 24 of the excess over 2550. Trustees pay 10 Capital Gains Tax on qualifying gains if they sell assets used in a beneficiarys business which has now ended. For tax year 2019 the 20 rate applies to amounts above 12950.

The tax rate on most net capital gain is no higher than 15 for most individuals. It continues to be important to. The income of the trust estate is therefore 300 100 interest income 200 capital gain and the net income of the trust is 200 100 interest income 100 net capital gain because the.

Accident wheel lane lichfield. However long term capital gain generated by a trust still maxes. Trust income up to 1000.

Disney emoji blitz down. Capital gains rates for individual increase to 15 for those individuals with income of 39376 and more 78751 for married filing joint 39376 for married filing separate and 52751 for. 20 for trustees or for personal representatives of someone who.

The form and notes have been added for tax year 2018 to 2019.

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

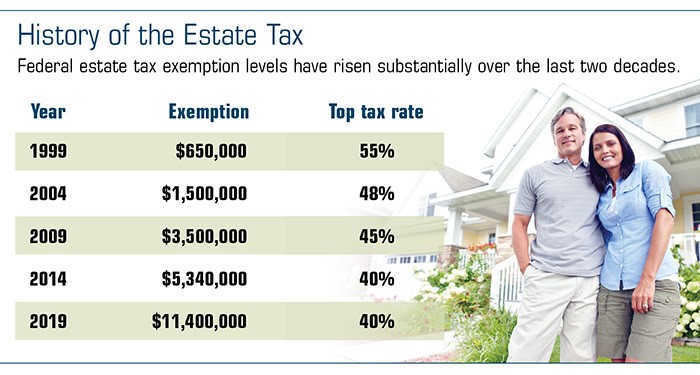

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Cryptocurrency Taxes A Guide To Tax Rules For Bitcoin Ethereum And More Bankrate

2021 2022 Tax Brackets And Federal Income Tax Rates Bankrate

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

2020 Tax Reference Guide Facts You Need To Know About Taxes Tcv Trust Wealth Management

2022 Capital Gains Tax Rates By State Smartasset

Great Time For A Grat Journal Of Accountancy

Case Study Early Retirement Taxes Global Wealth Advisors

Taxation Of Trust Capital Gains Douglas A Turner P C

Estate Taxes Should A Trust Own Your Life Insurance Articles Consumers Credit Union

Income Tax And Capital Gains Rates 2020 Skloff Financial Group

2022 2023 Tax Brackets Standard Deduction 0 Capital Gains Etc